Monzo Cash Deposit

Why there's a cash deposit limit. Criminals can use cash deposits for money laundering. We’ve done a few things to mitigate this already, but adding a deposit limit helps to reduce that risk even more. After getting feedback from customers, we think a limit of £1,000 over six months should work for most people. Your money in Monzo is FSCS protected up to £85,000. Compared to other UK banks, we’re 4x better at stopping card fraud, and 3x better at stopping identity theft.

- Monzo Cash Deposit Account

- Monzo Cash Deposit Credit Cards

- Monzo Cash Deposit Bonus

- Monzo Cash Deposit Account

- Monzo Cash Deposit Uk

Monzo ended its £5 refer-a-friend bonus at the start of this month, as the mobile bank crosses the three million customer mark.

Monzo told us 100,000 people had encouraged their friends to sign up for an account in the past two months alone, and that they’re closing the program in order to ‘grow in a controlled manner’.

Some Monzo fans have expressed disappointment that a feature they like is going away, but is this part of a wider trend?

Here, we take a look at how Monzo, and fellow challenger banks like Starling and Revolut, have changed what they offer as they’ve grown.

How big are mobile banks now?

Although most mobile challengers started out as apps with a small but dedicated user base, these banks have grown rapidly over recent years.

Monzo’s three million users are joined by over 775,000 Starling customers, three-and-a-half million N26 customers and seven million Revolut users, according to the brands’ official figures (although not all of these users are in the UK).

None of them rival the high street – Barclays, for example, boasts 24 million customers – but the numbers are impressive for organisations that didn’t exist a few years ago.

As they’ve grown, their customer offerings have also changed, sometimes expanding their perks, in other cases scaling back.

So here’s a rundown of what these card providers once offered, and what you can get now.

Keep in mind that these are not complete lists of all of these banks’ features. For more details, see our in-depth guide to challenger and mobile banks.

Monzo

Monzo Cash Deposit Account

How did it start?

Launched in 2015, the first Monzo customers actually signed up to a company called Mondo – the brand changed its name to Monzo in August 2016.

In its early days, it offered:

- Prepaid cards: the start of Monzo’s trademark ‘hot coral’ colour, they were not full current accounts, so customers couldn’t set up direct debits or have their salaries paid in.

- Unlimited fee-free overseas spending and withdrawals: a key draw for many Monzo customers, you were able to use your card abroad, anywhere that Mastercard was accepted, with no charges.

- App-based spending insights: as well as the fee-free overseas spending, many people signed up for Monzo cards to track their spending in the app.

How has it changed?

These are a few of the key features Monzo has added in the years since its launch.

- Full current accounts: Monzo secured a banking license in 2017, and prepaid cards were phased out in 2018.

- Overdrafts: Monzo has offered overdrafts since 2018 to customers who apply for them. Using one will currently cost you 50p per day, but that will have to change when the new FCA overdraft rules which ban daily charges kick in next April.

- Loans: launched earlier this year, Monzo’s loans start at a competitive 3.7%. You can borrow between £200 and £15,000, but only if you’re deemed eligible.

- Savings: Monzo has partnered with other banks to offer interest-paying savings accounts, though none of its rates are market-leading.

- Overseas ATM fees: the fee-free model was scrapped in 2017. Customers can now withdraw £200 abroad per month, with a 3% charge on foreign withdrawals thereafter. Transactions on card remain fee-free.

Starling Bank

How did it start?

Founded in 2014 by CEO Anne Boden, a former Allied Irish Bank executive, Starling launched publicly in 2017.

Early Starling customers received:

- Full current accounts: unlike Monzo, Starling started life as a bank, calling itself the UK’s first mobile bank. Accounts allow direct debits, and you can switch to Starling through the current account switch service.

- Spending insights: a staple of mobile banking, users could see breakdowns of their spending in the app.

- Fee-free international spending: Starling had (and still has) no fees and no limits for any overseas spending or ATM withdrawals.

- Overdrafts: up to £5,000, charged at 15% EAR with no daily fees. This is already compliant with the FCA’s upcoming rule change.

How has it changed?

Here are a few of the newer features Starling has added.

- Expanded marketplace: Starling’s ‘Marketplace’ feature has grown to include a number of different financial products and services from other companies, including savings, insurance, investments and mortgages.

- Euro accounts: launched earlier this year, Starling’s Euro Account lets you store and spend euro currency.

- Loans: Starling introduced loans in 2018, but with comparatively high 11.5% interest rates.

- Post Office deposits: you can deposit cash into accounts from most high street banks at Post Office branches.

- Current account interest: Starling was the first branchless bank to introduce interest on current account balances. It pays 0.5% AER on up to £2,000, and 0.25% on £2,000 to £85,000.

Revolut

How did it start?

Founded in 2015, Revolut has a primary focus on foreign currency exchange. Without no banking licence, Revolut is not actually a bank. This means it can’t offer FSCS protection for deposits.

Early customers were offered:

- Prepaid currency cards: which supported spending and ATM withdrawals in 90 currencies.

- Fee-free international spending, ATM withdrawals, and transfers: Revolut stressed that its card was completely free for all these features.

Monzo Cash Deposit Credit Cards

How has it changed?

Though it still focuses on currencies, Revolut’s offering has still changed.

- Overseas ATM fees: Revolut now has a similar overseas ATM fee structure to Monzo. You can take out £200 a month with no fees, and you’ll be charged 2% on anything above that.

- Support for 150 currencies: up from 90 at launch. Not all of these are free to use anymore, though. A ‘flat mark-up’ of 0.5% could apply to certain currencies on weekends.

- Support for cryptocurrencies: 29 of them.

- Fees for spending large amounts: if you spend over £5,000 a month, you’ll be charged 0.5%.

- Spending insights: like the banks we’ve looked at, Revolut’s app now includes money management features.

- Packaged accounts: Premium and Metal accounts are available for monthly fees, offering a number of additional features.

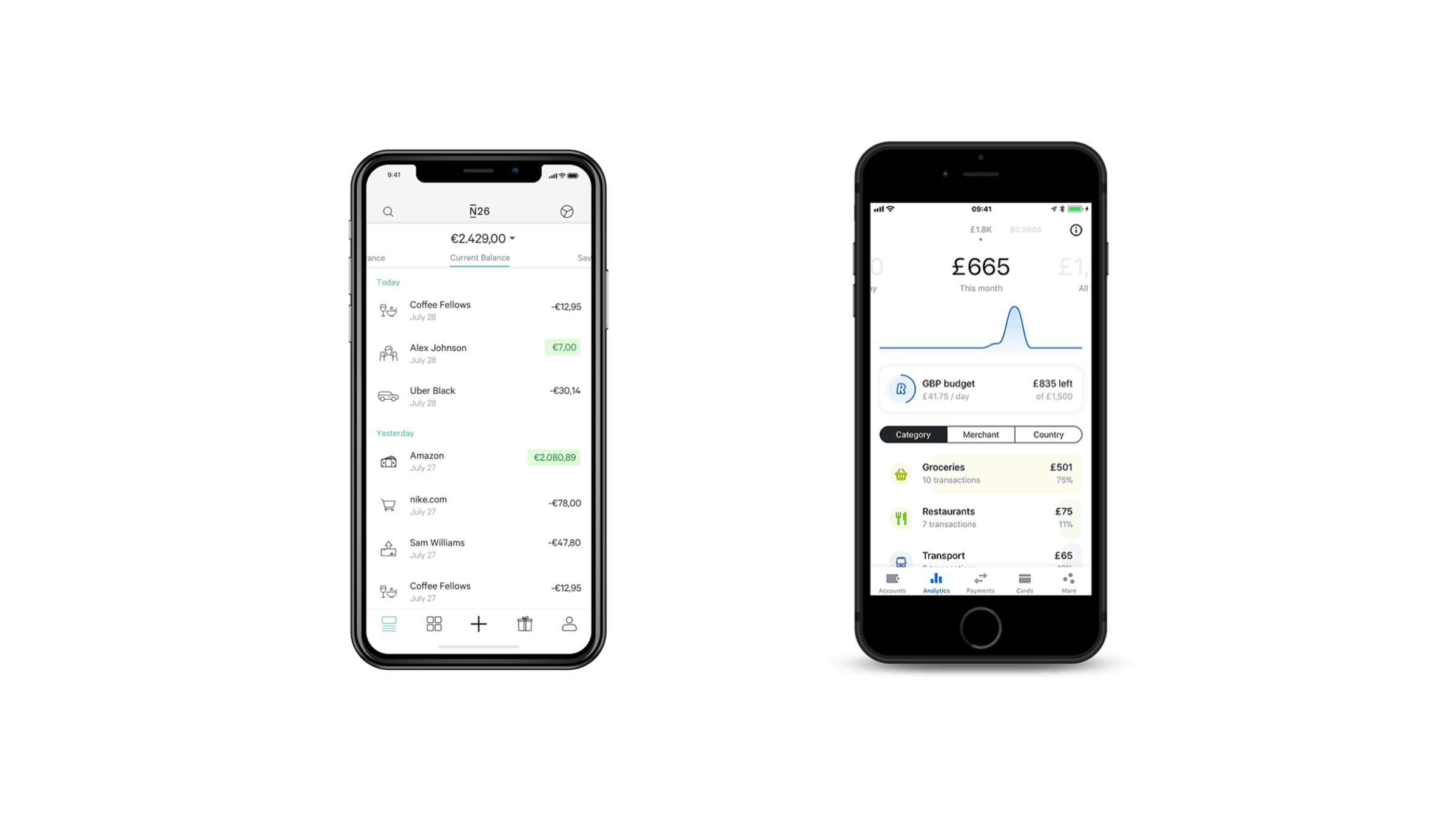

N26

Monzo Cash Deposit Bonus

How did it start?

German mobile bank N26 was founded in 2013. It only launched in the UK last year, so it hasn’t had time to change that much.

Monzo Cash Deposit Account

This is what it is currently offering:

Monzo Cash Deposit Uk

- Full current accounts: it already had a European banking license, so direct debits and salary payments were available from the start. But your money won’t be covered by the UK’s FSCS. (Up to €100,000 will be covered by Germany’s BaFin scheme instead.)

- Free ATM withdrawals in euros: with no monthly limits.

- Premium accounts: two different premium accounts with various additional features.

- Spending insights: like every other mobile bank in this article, you can use the N26 app to track your spending.

Editor’s note: This article has been updated to clarify details of N26’s current offerings.