Chase Deposit

return to footnote reference1Savings-account interest is compounded and credited monthly, based on the daily collected balance. Interest rates are variable and determined daily at Chase's discretion and are subject to change without notice. Balance tiers are applicable as of the effective date of these rates and may change at Chase's discretion. Account fees could reduce earnings. CD interest is fixed for the duration of the term and is compounded daily.

Chase offers retail bank services to individuals and businesses, including checking, savings, credit cards, mortgages and loans. Clients can review their account balances and transactions through online banking and mobile banking apps for iPhone, iPad, Android, Windows Phone or Kindle Fire devices. Chase.com:. Click on the last four digits of your account number that appear above your account information, or. Select the “Account & routing number PDF” from the “Things you can do” menu. I authorize (name of business) and my bank to automatically deposit my paycheck into my.

Find an ATM or branch near you, please enter ZIP code, or address, city and state. Interest begins to accrue on the business day of your deposit. Interest for CDs is calculated on a 365-day basis, although some business CDs may calculate interest on a 360-day basis. The Annual Percentage Yield (APY) disclosed on your deposit receipt or on the maturity notice assumes interest will remain on deposit until maturity. Learn about the benefits of a Chase savings account online. Compare Chase savings accounts and select the one that best suits your needs.

return to footnote reference2For Chase Premier SavingsSM: Earn Premier relationship rates when you link the account to a Chase Premier Plus CheckingSM or Chase SapphireSM Checking account, and make at least five customer-initiated transactions in a monthly statement period using your linked checking account. See interest rates.

Savings Text Message Program: Message and data rates may apply. For Help call 1-800-935-9935. Reply STOP to 33172 to no longer receive Chase Savings text messages until you provide your consent again. Mobile carriers not liable for delayed or undelivered messages.

IMPORTANT INFORMATION

The content of this page is informational only. Accounts are subject to approval. The terms of the accounts, including any fees or features, may change. See the Deposit Account Agreement and Additional Banking Services and Fees for the terms and conditions associated with these products.

Please turn on JavaScript in your browser

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Personal Banking Resource Center

Tools to help you manage your Chase personal banking accounts

COVID-19 Support

Sign in and find the resources you need. We’re here to help.

- Overview

- Self-service toolkit

- Fraud & security

- Contact us

Self-service toolkit

BeginFrequently asked questions

Get answers to common questions about Chase personal banking.

Fraud & security

If you suspect a charge on your account may be fraudulent, please call us immediately at the number on the back of your card.

- Fraud protection

- Security Center

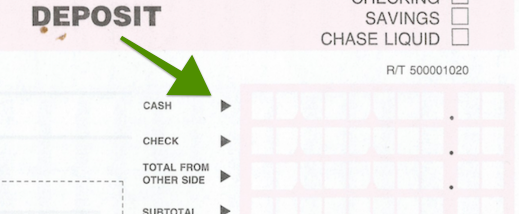

Chase Deposit Slips

Need assistance?

Chase Deposit Cut Off Time

Let us know if you have any questions about your personal banking account.