Best Fixed Deposit Rates

The best CD rates tend to be at online banks and credit unions. Or certificate of deposit, is a bank account with a fixed interest rate that’s generally higher than that of a regular savings. Find the best CD rates by comparing national and local rates. A Certificate of Deposit is a type of savings account that has a set interest rate and withdrawal date. Typically, CD interest rates. With the current economic slowdown, ICBC and DBS are leading the pack when it comes to accessible fixed deposits. ICBC offers 0.6% p.a. For 12-month tenures with an initial deposit of just $500 in fresh. Standard Chartered offers 100% secure, risk free & high interest rate Fixed Deposit Account. Start saving by booking a deposit with just GHS 1000. Best-Fixed Deposit Rates for Senior Citizen in India 2019-20. It is to be noted that interest rates are subject to change and can be revised by the bank without any prior notice. In the below grid are the best fixed deposit rates for senior citizens offered by banks in India.

Looking for the best fixed deposits in October 2020 in Singapore? If you have 50K, you should read my previous post on Where Will You Put 50K? before you jump straight into Fixed Deposits.

Fixed Deposit or Singapore Savings Bonds?

Forget about the Singapore Savings Bonds. The 1 year interest rate for November 2020 Singapore Savings Bonds has fallen as low as 0.23%, thus any of the fixed deposits promotion below will beat the Singapore Savings Bonds.

The Alternatives – Short Term Endowments

I have shared many other financial instruments that is similar to what fixed deposits can offer. One good alternative is buying a short term endowment plan. Endowment plans guarantee your capital upon maturity which is similar to what fixed deposits offer. Most of the short term endowment plans are on limited tranche basis.

At the point of writing, the second tranche of the popular NTUC Gro Capital Ease (1.96% for 3 years) is fully subscribed.

The Alternatives – GIGANTIC, Dash EasyEarn or Singlife

Best Fixed Deposit Rates Usa

Alternatively, you can check out GIGANTIC, Dash EasyEarn or Singlife whereby there is no lock in period and they offer a higher returns as compared to fixed deposits. Personally, I have signed up a Singlife Account and Dash EasyEarn.

| GIGANTIC | Dash EasyEarn | Singlife Account | |

| Lock In Period | No | No | No |

| Minimum investment amount | S$50 | S$2,000 | S$500 |

| Return rate per annum | 2.0% per annum on your first S$10,000 for the first year 1.0% for amounts above S$10,000 for the first year | 2.0% p.a. return for the first year (Guaranteed 1.5% p.a. + 0.5% p.a. bonus for first policy year, available on a first come, first served basis) | 2.0% for first S$10,000 1.0% for next S$90,000 Note: * From 1 November 2020, customers who spend S$500 within their specified card spend period on the Singlife Visa Debit Card will qualify for a bonus 0.5% p.a. return on top of the new base return of 2% p.a. for the duration of one policy month. |

Nevertheless, if you still prefer traditional fixed deposits, below are the best fixed deposits promotion that I have found for October 2020. The current low interest rates offered by most banks remained unattractive to me.

Among the banks below, I prefer the fixed deposit from DBS given that DBS offer much higher interest rate per annum for a 12 month placement as compared to the rest of the banks. You will not find any banks except DBS that pays you 1.15% p.a. for a S$20,000 placement.

DBS is the best fixed deposits in October 2020!

DBS Fixed Deposit (Recommended)

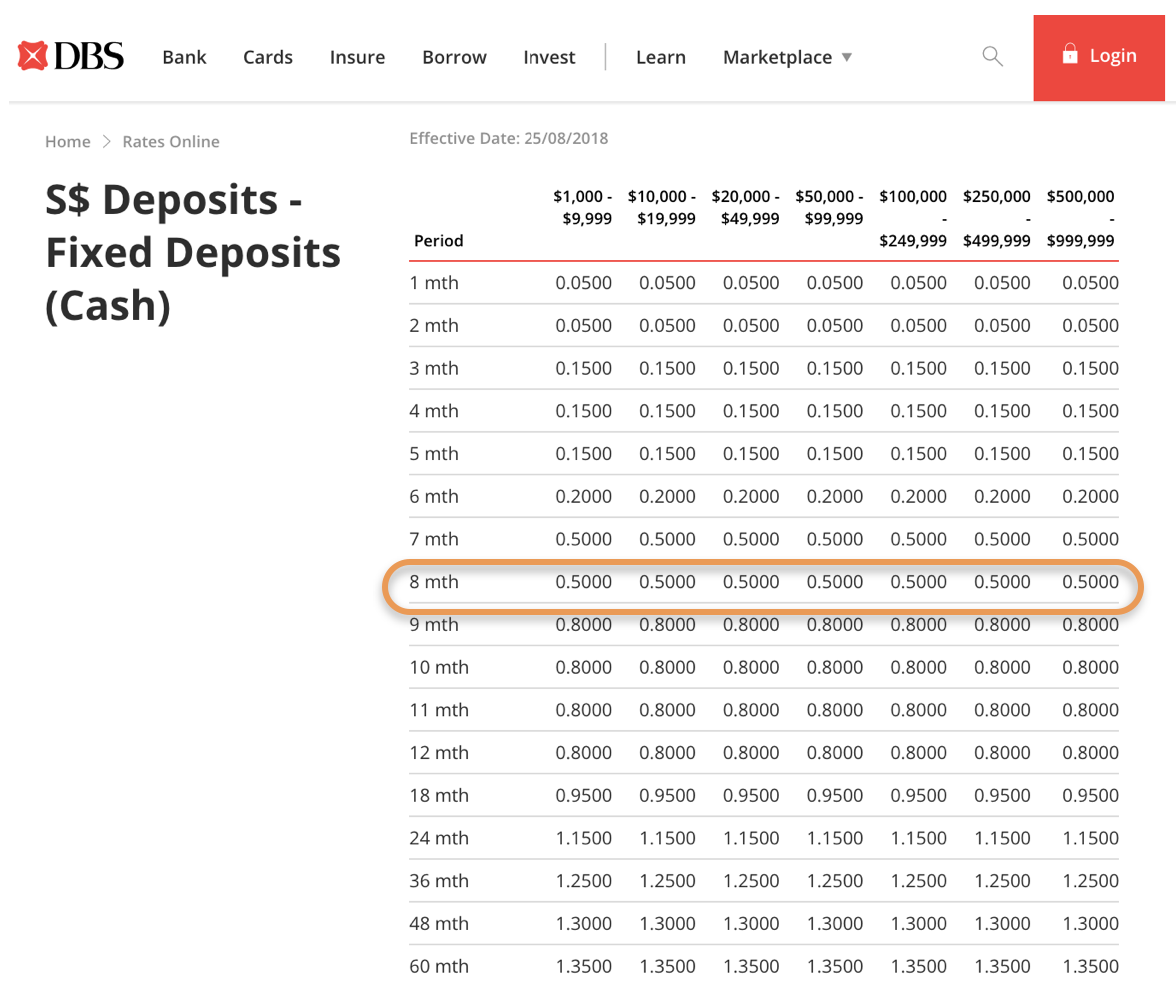

Interest Rate: Refer below, Minimum Placement: S$1,000, Promotion Valid Until: Not stated

The interests rates were published on 3rd September 2020. The interest rates for the amount tier S$1,000 to S$19,999 and other tenors remain unchanged. The interest rates for 12 months and above tenors are applicable only to rollover placements at the same tenors.

For a minimum amount of S$1,000, you can perform a fixed deposit placement with DBS. For a 12 months placement of S$10,000 at 1.15% p.a., the interest that you will receive upon maturity is S$115.

Hong Leong Finance Deposit Promotion

Interest Rate: Up to 0.85%, Minimum Placement: S$20,000, Promotion Valid Until: Not stated

For 12 months placement of S$20,000 at 0.85% p.a., the interest that you will receive upon maturity is S$170.00. This is on the condition that you perform the renewal or fresh funds deposit via PayNow.

| Deposit Amount | 12 months (Renewal or Fresh Funds via PayNow) | 12 months (Fresh Funds At Branch) |

| S$20,000 and above | 0.85% | 0.80% |

MayBank iSAVvy Time Deposit

Interest Rate: Refer below, Minimum Placement: S$5,000, Promotion Valid Until: Not stated

MayBank has reduced their interest rate across the tiers. Here are the interest rates for MayBank iSAVvy Time Deposit as of 9th October 2020.

For a 6 months placement of S$5,000 at 0.40% p.a., the interest that you will receive upon maturity is S$10.00.

For a 12 months placement of S$25,000 at 0.65% p.a. and 24 months at 0.85% p.a., the interest that you will receive upon maturity is S$162.50 and $426.81 respectively.

UOB Time Deposit

Best Interest Rates On Deposits

Interest Rate: 0.55%, Minimum Placement: S$20,000, Promotion Valid Until: 31st October 2020

The interest rate has fallen from 0.65% p.a. in September to 0.55% p.a. in October.

For 10 months placement of S$20,000 at 0.55% p.a., the interest that you will receive upon maturity is S$91.67.

| Minimum Placement (Fresh Funds) | Tenor | Promotional Rate |

| S$20,000 | 10 months | 0.55% p.a. |

OCBC Time Deposit

Interest Rate: 0.50%, Minimum Placement: S$5,000, Promotion Valid Until: 31st October 2020

OCBC has reduced their fixed deposit rate from 0.60% p.a. in September to 0.50% p.a. in October.

| Minimum Placement (Fresh Funds) | Tenor | Promotional Rate |

| S$5,000 | 12 months | 0.50% p.a. |

Best Fixed Deposit Rates In Us

For 12 months placement of S$5,000 at 0.50% p.a., the interest that you will receive upon maturity is S$25.00.

CIMB Fixed Deposit

Interest Rate: Refer below, Minimum Placement: S$5,000, Promotion Valid Until: 31st October 2020

For 12 months placement of S$5,000 at 0.30% p.a., the interest that you will receive upon maturity is S$15.00.

Best Fixed Deposit Rates Singapore

Standard Chartered Bank Singapore Dollar Time Deposit

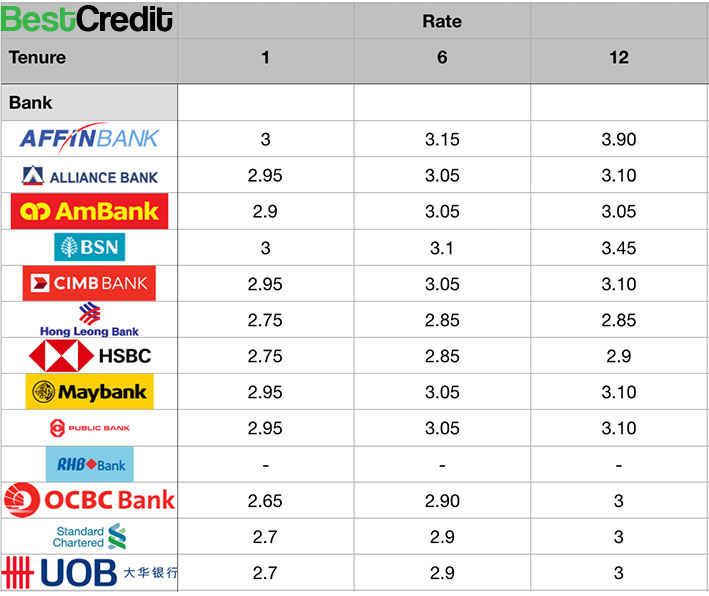

Best Fixed Deposit Rates In Malaysia

Interest Rate: 0.20% to 0.30%, Minimum Placement: S$25,000, Promotion Valid Until: 12th October 2020

For 6 months placement of S$25,000 at 0.20% p.a., the interest that you will receive upon maturity is S$25.00.

If you happen to be a priority banking customer, for 6 months placement of S$25,000 at 0.30% p.a., the interest that you will receive upon maturity is S$37.50.

Best Fixed Deposit Rates Today

| Minimum Placement | Tenure | Promotional Rate | Priority Banking Preferential Rate |

| S$25,000 | 6 months | 0.20% p.a. | 0.30% p.a. |