Bank Of America Check Deposit Time

Depositing a check is simple with our Bank of America Mobile Banking app. Start by opening your app, signing into your account, and selecting deposit checks. Then, take a picture of the front and back of the endorsed check with your smartphone or tablet. Hold your device steady, directly over the check, and the photo will be taken automatically.

Learn the procedure to follow when depositing mobile checks at Bank of America. This article will also include check depositing limits and the time taken to process mobile check deposits. If you also wish to know how to cancel mobile check deposits, continue reading this article.

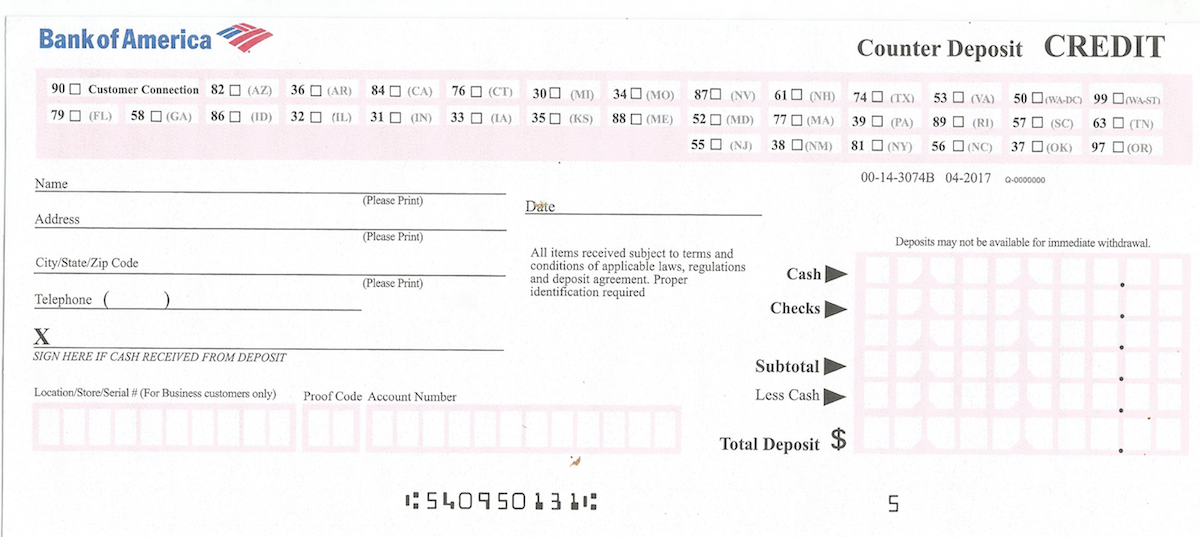

Paperless Deposits. Bank of America has been part of the trend to shift to paperless deposits. These deposits allow customers to drop a check in the ATM without an envelope. Instead, the ATM reads the information from the check, and the customer's receipt includes an image of the check. Perhaps your bank typically makes funds available the same business day that a check is deposited. If you go into a branch of your bank to deposit a check at 3 p.m., but its cutoff time is 2 p.m., your check won’t be processed until the following day. The deposit date will be postponed until the next business day, and so will your funds. Bank of America Credit account (Credit card, charge card, loan, line of credit) 11:59 p.m. ET for same-day credit. Bank of America Mortgage: For customers who pay with their Bank of America Checking or Savings account, 5:00 p.m. ET cutoff time gives you same-day credit: Bank of America Vehicle loans.

Contents

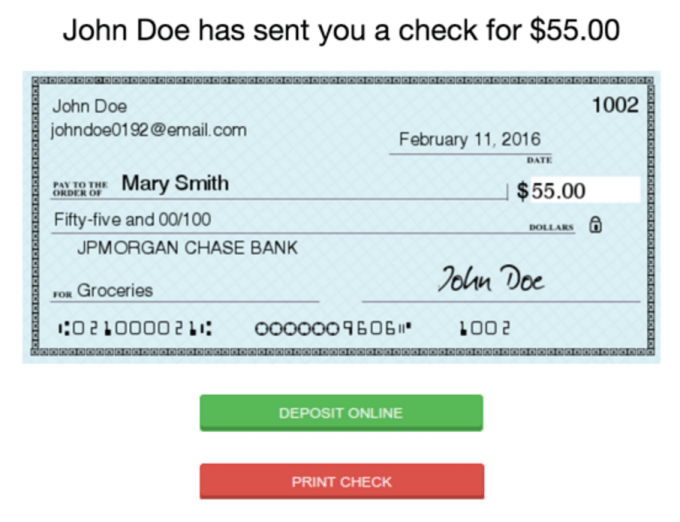

- How to deposit a check online at Bank of America

- Mobile check deposit Bank of America FAQs

How to deposit a check online at Bank of America

Bank Of America Pending Deposits

The Bank of America is one of the most accepted and used banks in the USA. Just like the other financial institutions, this bank has also attained a great deal and moved its services into the digital world.

Now you can deposit your check online from your destination; it can be at home, school, or workstations, without physically visiting the bank or its ATMs.

The process for depositing your check at this bank through the online method is indeed easier. Just follow the following few steps and you will be done in less than 30 minutes.

Step 1: Confirm that you have a strong internet connection

This is an important step. With strong internet connectivity, you are likely to spend less time depositing your check online.

Kindly, if you find that you find you have slow internet connections, use another option of depositing your check such as visiting the bank or move to a nearby cyber for strong internet connection.

Step 2: Confirm that your check is not fake

Confirmation of the genuineness of your check is the second most important step. It lowers the possibility of your check being rejected.

Step 3: Download the Bank of America official application

The app is available online at Google Play Store. Just download it or if you have it, go to the next step.

Step 4: Sign in to access your checking account or savings account

In case you find it difficult logging in, you can request for help from the Bank of America customer care team.

Step 5: Take a picture of your check

When taking the picture, make sure that you capture all the important details such as the amount and endorsement area.

Step 6: Upload your check

To upload your check is easier because there are steps and guidelines throughout the app, which are meant to guide you. Once you have uploaded the check, ensure the details you have entered are correct and submit your check for processing.

Step 7: Completion of depositing

You will receive a notification, once you are done. If it’s unsuccessful, you are requested to try again after rectifying the issue that could have led to the rejection of your check.

How long does Mobile check at BoA take?

Depositing a check through the BoA app usually takes twenty to thirty minutes. After this period, you will receive notification that your check has been accepted or not.

If it has been accepted, you are likely to see your money in your account after a maximum of fifteen days. The period depends on the number of clients who are using the application.

Mobile Deposit Limit Boa

BoA mobile check deposit time

If you have a strong internet connection, you are likely to spend less than 20 minutes to have your depositing process done. However, if your internet is slow, you may take a little bit longer.

BoA Mobile check deposit Limit

The mobile check deposit feature of this bank has some deposit limits, depending on the client’s time with the financial institution, and the type of your account.

Those with an account that has been active for less than 90 days are allowed to deposit 1,000 dollars a month. But, for those whose account has been operational for over three months, they can deposit up to 5,000 dollars in a single month.

Cancel Mobile Check deposit at Bank of America

As an esteemed client, you are given a chance to request the cancellation of your mobile check deposit. However, when requesting a cancellation, you are expected to give the reason why you are doing so.

After that, you will wait for a notification that your check deposit has been successfully canceled. For more details, kindly contact the customer care team.

Mobile check deposit Bank of America FAQs

There are several questions that individuals do ask themselves pertaining to the Bank of America. Nevertheless, the following is the most commonly asked questions that you will ever find in almost all platforms and forums.

Mobile check deposit BoA not working – what should I do?

In certain instances, you will find that the mobile checking deposit not to work. Usually, when there a massive system failure, clients are informed through their emails or texts. Again, if there is a planned maintenance program, you will be notified.

However, if you do not receive any notification and you experience a system failure, you are advised first to check your internet connection.

If the connection is strong, you should contact the customer care team to receive further instructions on what to do.

References on BoA Mobile check deposit

- Bank of America: How to use Mobile Check Deposit for Fast & Simple Deposits

- LendEDU: Can you cancel a check?

READ MORE: Banks with Mobile check deposit

Money and banking are increasingly becoming the subject of intense public debate. A recent example is the Dutch citizens’ initiative 'Ons geld' (Our Money); collecting more than 100,000 signatures in support of a proposal to put the power to create 'money' into the hands of government. The public debate surrounding this proposal is dominated by people who confuse money and

How (Central) Banking Really Works (I)

Money and banking are increasingly becoming the subject of intense public debate. A recent example is the Dutch citizens’ initiative 'Ons geld' (Our Money); collecting more than 100,000 signatures in support of a proposal to put the power to create 'money' into the hands of government. The public debate surrounding this proposal is dominated by people who confuse money and credit (money substitutes) whenever it fits their interests. That is why I will give some insights on money and banking, and explain why the 'Our Money' movement is wrong. This may end up becoming a mini-series out of this, so any feedback is appreciated.

Let’s Start With a Little History

Barter emerged when people decided to abandon their isolated existence; they started to trade apples for pears so to speak. Unfortunately, barter requires a 'double coincidence of want; ' someone who has an apple, but wants to have a pear has to find someone who has a pear and wants an apple.

So what happened over time?

People started to substitute less marketable goods for more marketable goods. In addition to their value in use, some of these goods obtained an additional ‘value in exchange;’ a price premium because they could be traded away easily in later exchanges. This evolution took place over a long time period.

A wide range of goods can be used as a medium of exchange: shells, sand, and so on. Indeed, the term 'salary' is derived from the Latin term 'salarium,' meaning salt, as the Romans at one point were paid out in salt.

Eventually, metallic money 'won' the battle. The precious metals are very suitable for usage as money; they are divisible, homogenous in nature and do not perish. A monetary metallic standard emerged.

The Evolution of the Banking System

Bank Of America Stimulus Check Deposit Time

The banking industry also developed during this time. People wanted to store their gold and vault owners — the precursors of modern banks — provided this service at a fee.

Little by little, these storage services developed into modern banking. A famous example is the Dutch Bank of Amsterdam that enjoyed international esteem. Gold was stored in the bank and all transactions (all gold deposits) were filed into a bookkeeping system. Transactions among clients could simply be balanced out in the books.

This modern bank was a 100% reserve bank; a bank that kept a 100% gold reserve against its checking deposits. The Bank of Amsterdam would be the last bank of this type. Since 1820, there have only been banks that operate with fractional reserves.

The Rise of Central Banking

In 1844, not long after the Bank of Amsterdam was dissolved, the banking act promoted by Robert Peel was enacted by parliament in England. This act made the issuance of bank notes the exclusive privilege of the Bank of England. Moreover, Peel’s act required all bank notes to be fully backed by physical gold and silver.

The 19th century was marked by a series of banking crises and recurring cycles of economic booms and busts. Robert Peel recognized that recessions had a monetary cause, and he believed that they could be ruled out by preventing the issuance of additional bank notes through a 100% reserve requirement and by concentrating this power by allowing only one bank to issue bank notes.

Incidentally, this is the reason why there is only one type of bank note in both Europe and the U.S. — those of the European Central Bank (ECB) and Federal Reserve — and why no bank notes issued by commercial banks like ING, BNP Paribas or Citibank exist, as was once the case in Scotland. Robert Peel’s banking act centralized the issuance of paper bank notes.

As a result of Peel’s act, commercial banks no longer held any gold (or silver), but simply opted for deposits at, or paper notes of, the Bank of England. As a matter of fact, Robert Peel centralized not only the issuance of bank notes, but also the banks’ gold reserves.

A tiny detail; as an 'emergency measure,' the 100% reserve required was suspended during the very first economic downturn that followed Peel’s act.

The Semi Gold Standard

Until 1971, the world operated under a semi gold standard. In 1944, at the Bretton Woods conference, the semi gold standard had made way for the dollar standard in many countries. However, at that time the U.S. dollar was still 'as good as gold.' In 1944, non-U.S. central banks started to hold dollars instead of gold. Before 1944, the gold reserves of each country were centrally held at the national central bank.

However both periods, before as well as after 1944, were marked by the fact that the gold supply of each country was in the hands of a central authority.

Since the transition to a semi gold standard — from a system in which checking deposits, payable on demand, were backed by gold held at the bank — the concept of money has changed. Gold is no longer money, the liabilities of central banks are.

Today, claims on banks are only claims to paper bank notes issued by our national central banks (that are not redeemable into something else).

Surprise: Your Checking Account Balance Is Not Money

To many, it will be a surprise to hear that the money on your checking account is not actually money; it is a loan to the bank which is payable on demand. You do not own money, but a bank liability. Usually, these claims are as good as money, but there is an important difference.

I want to stress that this difference between money and debt — or rather, bank liabilities — is of crucial importance to understand money and the monetary system.

A bank does therefore not 'create money out of thin air.' It issues liabilities which are redeemable into paper bank notes of the central bank, and which might also be accepted by other commercial banks as payment.

However, the government has done everything it can to underwrite these bank deposits (i.e., bank liabilities).

In almost all countries, deposit guarantee schemes have been enacted. As a consequence, deposit holders have become indifferent towards the creditworthiness of banks. A central bank is the lender of last resort. And in case that is not enough, the government — and thus taxpayers — assume the burden of the banks.

The balance on your checking account is therefore a money substitute, instead of money. Your checking account balance is a loan to the bank. The liabilities of the central bank are money.

Next week, we will discuss the granting of credit by commercial banks. If you have any remarks or questions, please do not hesitate to contact me.